The UK has announced a new tax targeted at tech giants, in an attempt to claw back revenue disappearing into the global digital economy.

|

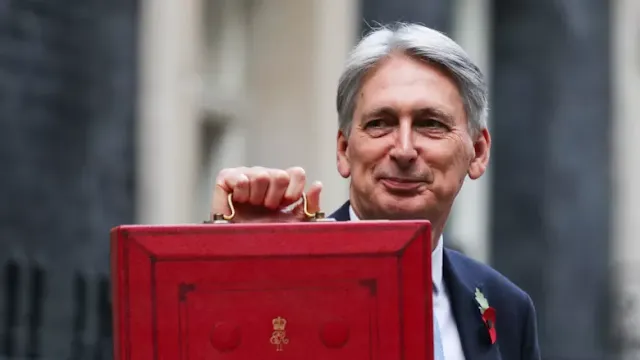

| Tech giants to pay new 'digital services tax' in UK, says chancellor Philip Hammond. |

The new “digital services tax” is forecast to raise £400m ($720m) a year for the British treasury to ensure online platforms “pay their fair share towards supporting our public services”, Chancellor Phillip Hammond announced in his budget speech on Monday.

He said his country would take an international lead in reforming the corporate tax system.

A new 2 per cent ‘digital services tax’ will be levied on the UK-generated revenues of search engines, social media platforms and online marketplaces which are profitable and earn at least £500m ($900m) globally – including companies such as Google, Facebook, eBay and Amazon.

The tax will apply to revenues from ads on social media targeted at UK users, commissions in online marketplaces on transactions between UK users, and display advertising next to search results.

But Hammond said the levy would not be designed as a sales tax, in an attempt to avoid the cost being passed straight on to consumers.

“That is not our intention,” he said.

The DST will begin in April 2020 and after a few years is forecast to bring in more than £400m ($720m) a year to the British treasury.

Hammond said the tax would be “carefully designed to ensure it is established tech giants – rather than our tech start-ups - that shoulder the burden of this new tax”.

It may be a temporary measure.

The G20 finance leaders have agreed on the need for a “consensus-based solution” to taxing the digital economy, and the OECD and European Commission have been working on proposals for new international tax rules to tackle digital firms that shift their revenue and profits to tax havens far from where the income was generated.

The OECD’s aim is to reach agreement by 2020 but Hammond said progress had been “painfully slow”, and it was “clearly not sustainable or fair that digital platform businesses can generate substantial value in the UK without paying tax here”.

The tech giants have used (legal) tax tricks to pay minimal tax in the UK compared to revenue. Industry analysts told the Telegraph that Facebook generated nearly £2b in advertising revenue in 2017 but paid just £16m tax, and Google paid just £50m tax on £4.4b in revenue.

techUK CEO Julian David told Computer Business review the UK’s new tax would be bad for investment and bad for the UK economy, and no tax should seek to “narrowly target businesses simply because they are digital”.

“This is an international tax issue that needs and internationally agreed solution,” he said.

|

| Amazon: To be taxed more thoroughly |

Hammond said the tax would be reviewed in light of any international action.

Hammond also announced a tax cut for “high street” businesses such as independent pubs, shops, restaurants and cafes.

The UK budget speech – the longest in a decade - contained few grand plans, concluded with a modest tax cut and consisted mostly of a patchwork of quick fixes: pothole filling, school hall repairs and funds to fix public toilets (a cue for a bout of toilet puns from the Chancellor).

It also included a £1b boost to defence spending, for cyber warfare and anti-submarine capability.

The theme was a gradual turn away from austerity economics.

In her conference speech this autumn prime minister Theresa May pledged “austerity is over”, but the chancellor said only that it was “coming to an end but discipline will remain”, a line he repeated twice.

Opposition leader Jeremy Corbyn said austerity was not over, and the budget was a “broken promise” budget of “half measures and quick fixes while austerity grinds on”.

The budget did have some good news for Australians, though. Along with Americans, Canadians and New Zealanders, we will soon be able to use the e-Passport gates on arrival at Heathrow.

0 Comments:

Post a Comment